|

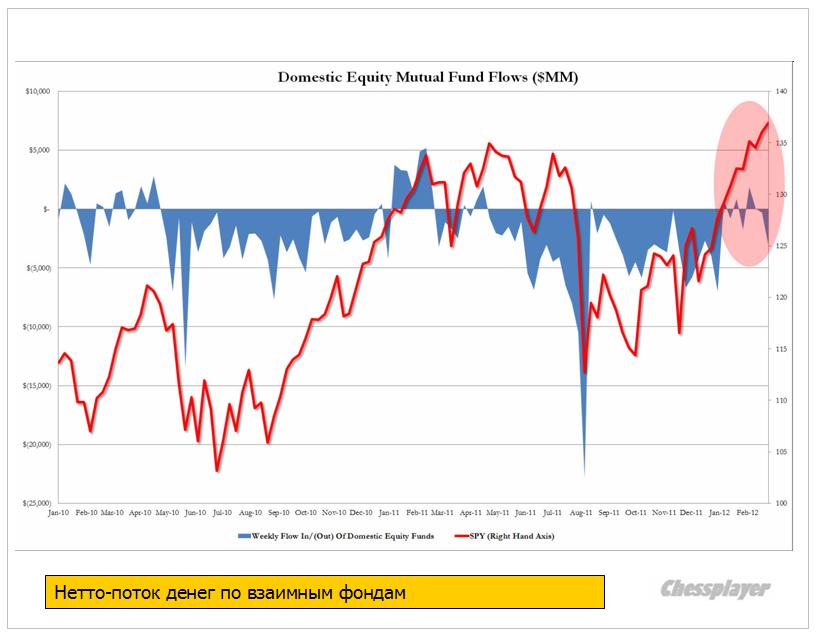

LINKS-ДАЙДЖЕСТ 07 марта 2012 г. Пенсионные фонды Греции против обмена бондов Минфин Греции: 6 крупнейших банков обменяют долги Греция опровергла перенос дедлайна по PSI Греция "кинет" инвесторов, которые не обменяют бонды Италия продает долги с защитой от инфляции Греция начала отсчет до конца программы PSI Нидерланды готовы поддержать расширение ESM Cложно сказать, что будет с Грецией 58% инвесторов согласны на своп Промзаказы в Германии внезапно просели на 2,7% .................................................................................... теперь англоязычные Is Gold Suffering Under ECB Margin Calls? Пострадает ли золото от маржинколов ЕЦБ? Last night we noted the very concerning rise in margin calls for European banks thanks to collateral degradation at the ECB. This story has become very popular as traders try to figure out which assets were deteriorating rapidly and which banks face immediate cash calls. One thing that came to mind for us was - what about Gold? Coincidentally or not, the last time we saw a big surge in collateral margin calls by the ECB (in September of last year), not only did Gold lease rates explode (implode) but Gold prices fell off a cliff as the squeeze came on from gold liquidity providers pushing prices down to exacerbate the negative lease rates on the gold collateral. The point here is that as margin calls come in from the ECB, we wonder whether banks will be forced to liquidate their gold (last quality collateral standing) to meet the ECB's risk standards. The key will be to watch gold lease rates (as we explained here and here) and ECB Margin calls to see if Gold is merely suffering a short-term dip from USD strength derisking or if this is a more broad based meeting of collateral desperation need that might have legs - only to be bought back later. MtM losses combined with collateral calls (as we noted earlier) was never a recipe for success and we will be watching closely Central Bank Attempt To Sucker In Retail Investors Back Into Stocks Has Failed На этот раз мощное ралли с конца октября не привело к заметному притоку «глупых денег» (розничных клиентов), Мало того, они уже сейчас начали разгружаться от лонгов. Кому «умные деньги» будут сдавать свои лонги? In what should come as no surprise to anyone who has a frontal lobe, yet will come as a total shock to the central planners of the world and their media marionettes, the latest attempt to sucker in retail investors courtesy of a completely artificial 20% stock market ramp over the past 4 months driven entirely by the global liquidity tsunami discussed extensively here in past weeks and months, has suffered a massive failure. Exhibit 1 and only: as ICI shows today, following what is now a 20% ramp in the stock market, not only have retail investors continued to pull out cash from domestic equity mutual funds (about $66 billion since the recent lows in October, the bulk of which has gone into bonds and hard commodities), but the week of February 29, when the market peaked so far in 2012, saw the biggest weekly outflow of 2012 to date, at -$3 billion. Alas, this means that the traditional happy ending for the authoritarian regime, whereby stocks get offloaded from Primary Dealers, and GETCO's subsidiaries, to the retail investor, is not coming, and soon the scramble for the exits among the so-called "smart money" will be a sight to behold.

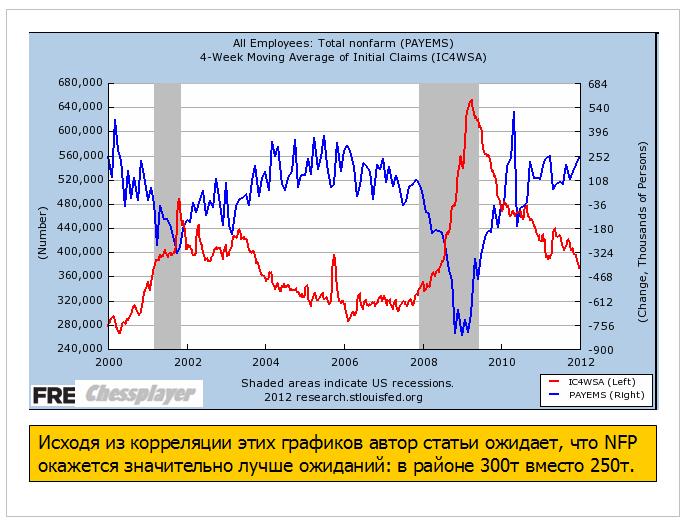

Розничные инвесторы массово последние три года покидают рынок акций и не видно, что их могло бы остановить. On Wall Street, risk is suddenly a four-letter word. Retail investors can't stomach it. Pension plan sponsors are allocating away from it. That's bad news for stocks. Volume has been dropping almost nonstop for three years and shows no signs of improvement. The situation is worse than it was following the crash of 2000. It's worse than it was after the crash of 1987. Fearful of the future and still wincing from 2008, investors are moving funds into bonds, commodities, cash, private equity, hedge funds and even foreign securities-anything but U.S. stocks. Рынки разрушены вмешательством монетарных властей и новыми технологиями. Wall Street's Knee Jerk Responses To Hint Of More QE Мнение Уоллстрита относительно намеков на новое «стерилизованное» QE The Death of The PIIGS Illustrated Предстоящая гибель PIIGS с иллюстрациями Jim Grant Must Watch: "Capitalism Is An Alternative For What We Have Now" Джим Грант: «Капитализм – это прекрасная альтернатива тому, что мы сейчас имеем». Интервью, которое ZH очень рекомендует посмотреть. REVEALED: Business Insider's Official Prediction For Friday's Jobs Report Официальное предсказание от Business Insider по поводу предстоящего в пятницу отчета по занятости Goldman Reveals The Frustrating Reason That Big Government Debts Slow The Economy Есть несколько причин, которые связывают высокие уровни госдолга с последующими низкими темпами роста There are several reasons why high levels of public debt may be associated with lower growth outcomes. The first is simply that at some point debt needs to be repaid. After periods of significant debt accumulation, fiscal consolidation will usually be needed to ensure that the debt path is sustainable. As we have shown elsewhere, fiscal consolidation tends, on average, to be a drag on growth. So the price for delivering sustained tighter fiscal policy may be a period where growth is weaker. QE Set To Leave British Pensions $141 Billion In The Hole Второй раунд количественного смягчения вынет из карманов пенсионных фондов Великобритании 90 млрд. фунтов стерлингов. A second round of quantitative easing in the UK will leave the country's pension funds £90 billion ($141 billion) out of pocket, the National Association of Pension Funds (NAPF) announced on the third anniversary of QE in the UK. QE hurts pension funds especially by making government bonds more expensive, forcing buyers onto more risky investments — which, due to their nature, pension funds tend to avoid. NAPF says that an average person with a pension pot of £26,000 pounds can now expect 22 percent less income than four years ago at a loss of 440 pounds a year. Reuters reports that Bank policy maker David Miles has argued that those about to retire should find their costs offset by a rise in their investment funds. NAPF estimates the first round of QE cost pension funds £180 billion ($283 billion), the BBC reports. Программы QE разрушают пенсионную систему “Businesses running final salary pensions are being clouted by QE. Deficits that were already big now look even bigger because of its artificial distortions. “Pension funds want a stronger economy, so they are on board with the QE project for now. But the latest bout of £125bn of money printing has blown a £90bn hole in their side. We need help in managing that. Pension funds cannot be left holding the baby. “Firms are legally obliged to fill the deficits, and that diverts money away from jobs and investment, and will lead to further closures of final salary pensions in the private sector. Retirees trying to get a good annuity are feeling the pain too – they are getting a fifth less than they would before QE started. “We need to see stronger action from the authorities on this massive issue, which will hurt pension schemes for some time yet. And there is always the possibility of QE3.” ROBERT SHILLER: This Might Be The 'End Game' For Falling Home Prices Роберт Шиллер признает, что, возможно, цены на недвижимость США достигли дна. Anyone who follows Robert Shiller closely knows that it's hard to get him to commit to calling a bottom in the housing market, which continues to see prices fall. "I just don't see any scientific way to be assured what it's going to do," he told CNBC in an interview today. This is coming from the same economist who predicted the housing bubble in the second edition of his book Irrational Exuberance. However, his tone seems to have turned a bit more optimistic. "It could turn around," Shiller told CNBC's Brian Sullivan. "We're seeing some good news now. Starts, permits, confidence, the NAHB housing index is strikingly up. It's still low, but it's up." STOCKS RALLY EVERYWHERE: Here's What You Need To Know А здесь перечислены причины, по которым сегодня везде ралли. Wait, There Are Some Really Ugly Details In This Consumer Credit Report Подождите, что-то все же есть неприятное в этом отчете по потребительскому кредиту Why This Friday's Jobs Report Could Blow Past 300,000 Автор статьи ожидает, что NFP окажется гораздо лучше ожиданий

LEAKED MEMO REVEALS: What A Greek Default Will Cost Europe And The World Что греческий дефолт будет стоить Европе и миру Libor Links Deleted as U.K. Bank Group Backs Away From Rate Грядут изменения в расчете процентной ставки LIBOR The British Bankers’ Association, the century-old lobby group that oversees the rate, last week deleted references from its website referring to its role in setting Libor. This week, it met regulators and bank executives to review the future of the benchmark. Under one option, the Bank of England’s proposed Prudential Regulation Authority would take responsibility for policing the rate, said a person with knowledge of the talks who asked to remain anonymous because discussions are private. The BBA says it isn’t seeking to cede oversight to the regulator. ADP Reports 216K Private Payrolls Added, On Top Of 215K Expectation Данные от ADP по занятости оказались в рамках ожиданий. LTRO - Scratching The Surface Peter Tchir из TF Market Advisors акцентирует внимание на некоторых деталях, относящихся к проведенным тендерам LTRO 1. эти займы через год могут быть погашены 2.плавающая ставка The loans have a 3 year maturity, but it seems as though the rate paid will be reset periodically in a way that should track the ECB overnight rate. That isn’t exactly how it is described, but seems to be the jist of it. With the Fed on hold until 2014 and the ECB under Draghi much more accommodative, it seems likely the rate will remain low, but it isn’t guaranteed. That puts a slight damper on the “carry trade” enthusiasts. Italian 2 year bonds yielding 1.78% aren’t that appealing, especially if the funding cost can increase. 3. От банков потребуется довносить залог в том случае, если стоимость обеспечения снизиться. Variation Margin Zerohedge pointed out a spike in additional collateral being posted at the ECB. According to some documents, the ECB is required to impose variation margins on its financing operations. This means that the collateral posted is not a one-time deal. If the collateral a bank has posted declines in value, the banks would have to post additional collateral. This is a big deal. Somehow the world seems to have an image that banks can borrow 3 year money at 1%, pledge an asset against it, and let the carry take effect with no other consequences. That is far from the truth if variation margins are being used. Вот это действительно важно. Having to post variation changes the product a lot. Buying longer dated bonds becomes very risky. They remain volatile and although banks could hold them in non mark to market books to avoid that volatility hitting their P&L, it wouldn’t save them from posting variation margin if the holdings decline in value. That helps explain why the curves are so steep, and really will limit the ability of banks to hold down longer term yields if we get another round of weakness, the death spiral risk is too scary. Покупать долгосрочный спектр облигаций рискованно, поскольку они гораздо более волатильны. И хотя банки могут их держать за балансом, это все-равно не избавит их от нелбходимости показывать изменение вариационной маржи. Это в какой-то степени объясняет, почему происходит уплощение кривой доходности по европейским долговым бумагам Это может стать в какой-то момент причиной раскручивания новой долговой спирали Portuguese banks should be of particular concern – again. The 2 year Portuguese bonds have jumped from a price in the low 80’s to the low 90’s. If banks bought these bonds as LTRO the potential for death spirals is on. As the bonds start declining in value, the banks would have to post collateral. Since the Portuguese banks are surviving almost exclusively on central bank money, their only choice would be to pledge some unpledged assets (if they have any), or sell the bonds and try and repay some of the LTRO. Selling bonds would put additional pressure on a then weak market. So the banks will pledge more assets. This does nothing to stop the slide in the underlying bonds, but would subordinate senior unsecured debt holders further. Senior unsecured debtholders will run for the hills again. They will see assets being taken out of the general pool – where they have a claim – and get shifted to the ECB, where ECB has the first rights. Особенно уязвимыми в этом отношении являются португальские облигации. Like anything else, once this becomes a concern in Portugal, the contagion fear is likely to raise it’s head. With €1 trillion of assets part of the LTRO program, even a 2% decline in assets pledged, would require banks to pledge 20 billion of additional collateral. Italian 2 year bonds have jumped 10 points since LTRO. Is that sustainable? Is there no risk they drift down again? Variation margin is leverage at the extreme. It creates risk to the mark to market of the underlying assets, and makes the “carry trade” option far less interesting, or more scary for any institution that has prudent risk management. Ah, yes, that explains why LTRO dependent banks and those most interested in playing the “carry” game are trading weaker than their peers – they are demonstrating that they are not prudent. Имея активов более чем на 1 трлн. EURO (уточню - на самом деле их больше, как минимум 1,3-1,4 трлн, поскольку многие активы, особенно во время LTRO-2 принимались с дисконтом), даже снижение их стоимости на 2% повлечет за собой изъятие у банков 20 млрд. EURO. Таким образом ликвидность в еврозоне стала очень чувствительна к доходности долговых бумаг долгосрочного спектра.

|